Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

Farewell to Yet Another Failed Monetary System

In monetary and economic history, chaos is the rule rather than the exception. Our modern world is no different than the countless civilizations and nations that have failed previously. Policies meant...

Egon von Greyerz / August 4, 2021

Read More

Grant Williams, Egon von Greyerz, and Ronnie Stoeferle: The Crack-Up Boom

Watch some of the brightest minds in finance, Grant Williams, Egon von Greyerz, and Ronnie Stoeferle discuss fiscal policy, the "crack-up boom," inflation, liquidity, and of course gold and silver in...

Egon von Greyerz / July 28, 2021

Watch Now

THE PAPER GOLD TAIL WAGGING THE GOLDEN DOG

Paper gold controls the gold market, but this cannot last forever. Eventually, the golden dog will take control of his own tail. When fiat currencies inevitably fail, Physical gold reigns supreme.

Egon von Greyerz / July 21, 2021

Read More

GRANT WILLIAMS, RONNI STOEFERLE, AND EGON VON GREYERZ SPEAK TO GOLD’S INFLATIONARY END-GAME

As large swaths of the world gather to follow the best names in “round-ball” football, we’ve gathered three of the best names in the global financial and precious metal playing field to discuss critic...

Egon von Greyerz / July 10, 2021

Watch Now

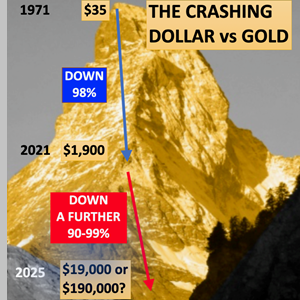

THE DOLLAR’S FINAL CRASH DOWN A GOLDEN MATTERHORN

Was Richard Nixon a real gold friend who understood the futility of tying a weakening dollar to gold which is the only currency that has survived in history? So was Nixon actually the instigator of th...

Egon von Greyerz / July 7, 2021

Read More

VON GREYERZ: BASEL 3 – GAME CHANGER FOR PRECIOUS METALS OR NON-EVENT?

The FOMC caused turmoil last week, but the statements have only short-term effects. In the past, the FED could not predict anything correctly, but only react. It will be the same this time. Real inter...

Egon von Greyerz / June 30, 2021

Watch Now

THE ICARUS WAX OF THE EVERYTHING BUBBLE IS MELTING

When will the wax melt that holds up the global economy and everything bubble? Hubris is driving humans and markets ever higher and closer to the sun. The higher everything goes, the greater the risk...

Egon von Greyerz / June 23, 2021

Read More

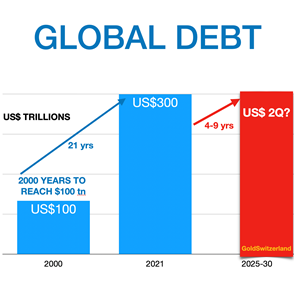

GLOBAL DEBT FROM $300 TRILLION TO $2 QUADRILLION IN NEXT 5-10 YEARS

The coming 5-10 years are likely to see asset prices decline by at least 90% in real terms. Yes stocks, bonds and property prices will in coming years collapse. But that’s not enough, the whole struct...

Egon von Greyerz / June 16, 2021

Read More

FROM YELLEN’S TWEETS TO BASEL III, GOLD CAN ONLY TREND NORTH AS CURRENCIES CAN ONLY GO DOWN

In this 20-minute MAMChat, Matterhorn Asset Management principals Egon von Greyerz and Matthew Piepenburg address the current and ever-evolving inflation narrative as well as its inter-relationship wi...

Egon von Greyerz / June 14, 2021

Watch Now

HOCUS – POCUS SCHEME TO CAUSE DRAMATIC GOLD SURGE

“The scholar does not consider gold and jade to be precious treasures, but loyalty and good faith.” - Confucius

This article will disc...

Egon von Greyerz / June 2, 2021

Read More

BANK VAULTED GOLD: GONE WHEN NEEDED MOST

Institutional investors are increasingly adding gold to their portfolios as a currency and inflation hedge. Those, however, who chose ETF’s for such an allocation face massive delivery risk of the ass...

Egon von Greyerz / June 1, 2021

Watch Now

EXPONENTIALITY LEADS TO FINALITY

As technological developments and markets go parabolic, we observe many market “experts”, even intelligent ones, forecasting that we are now in an exponential economic era. Thus many believe that this...

Egon von Greyerz / May 26, 2021

Read More