KWN – EvG – Gold could be $2,000 by end March

that in the last eighteen months world money supply has gone up by $10 trillion and that the Greek package is not a solution.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

KWN – EvG – Gold could be $2,000 by end March

“Das derzeitige Finanz-System wird völlig zerstört werden”

DAS MATTERHORN INTERVIEW – Februar 2012

John Embry, der Chef-Investmentstratege bei Sprott Asset Management, spricht in diesem exklusiven Interview über die Motive und Mittel bestimmter Interessen, einen freien Goldmarkt zu verhindern; benennt den Grund, warum der Goldpreis hoch bleiben wird; zeigt die Möglichkeiten beim Silber auf; und erklärt: “Gold ist die am weitesten von einer Blase entfernte Sache, die ich mir vorstellen kann.” (more…)

KWN – EvG – Gold could be $2,000 by end March

GATA: “Debt derivatives and gold will explode shortly, von Greyerz tells King World News”

KWN: “Greyerz – Gold to Begin a Major Advance Starting Next Week”

Goldswitzerland:”Greek default is the best solution”

In the February 17 interview with Eric King, Egon talks about a Greek default, the imminent fall of the dollar and the potential collapse of the financial system. He also gives a short term forecast for gold.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

KWN – EvG – Gold could be $2,000 by end March

“Gold is about the furthest thing from a bubble that I can think of.“

We are very fortunate to feature my very good friend John Embry in this month’s Matterhorn Interview. John who knows more about the gold market than probably anyone I know, talks about the “chicanery” in the gold market and why.

He also explains why he is so bullish about silver, about the possible demise of paper money and much, much more.

Egon von greyerz

“The Current Financial System Will Be Totally Destroyed“

THE MATTERHORN INTERVIEW – February 2012

Mr. Embry, the perhaps best report I have ever read on the gold market was “Not Free, Not Fair: The Long-Term Manipulation of the Gold Price,” written by Andrew Hepburn and you. (1) I would like to talk with you at the beginning about the findings of that report. First of all, why do you think it is relevant whether the gold price is free or not?

John Embry: Thank you for the very generous compliment. It is essential that the gold market be free. It functions as the so called “canary in the coal mine” and its price should be allowed to reflect excesses in a pure fiat monetary system. The continued suppression of the gold price was a key factor in the many financial bubbles which have essentially wrecked the monetary system as we know it.

What has the evidence been that the gold market isn’t a free market?

John Embry: Our report which was written 7 ½ years ago revealed all sorts of chicanery in the gold market and we only used evidence which could be corroborated. Considerable additional evidence has piled up subsequently but two smoking guns are the repetitive counter intuitive price action and evidence of widespread clandestine leasing of western central bank gold.

Who are the ones that don’t like a free gold market and which objectives do they have in mind by preventing a free gold market?

John Embry: The western governments, their central banks and the allied bullion banks are the culprits. They view gold as a mortal enemy of the fiat currency system. Gold has been real money for centuries and every paper money system in history has ultimately collapsed. This drives them to continuously denigrate and manipulate gold.

Through which tools is the gold price “managed“?

John Embry: The worst damage occurs in the so-called paper gold market where derivatives, naked shorting, vicious margin hikes, etc. are employed to fleece the long side who don’t have as deep pockets. In addition, the western central banks have supplied the physical gold necessary to effect the plan through their leasing.

Recently, I was told by a former chairman of the Federal Reserve, Paul A. Volcker, that to his best knowledge “the U.S. has not intervened in the gold market for more than 40 years.“ (2) Do you think Mr. Volcker has the truth on his side?

John Embry: Mr. Volcker admitted that the U.S. had made a mistake by not intervening at one point in the gold market some 40 years, so to think that nothing has happened subsequently is extremely naïve. Technically he might be correct in the sense that swaps could have been employed and the intervention using U.S. gold could have been conducted by another party. Recently retired Fed Governor Kevin Warsh acknowledged U.S. gold swaps in correspondence with GATA just last year. (3)

Furthermore, Mr. Volcker seemed to suggest that central banks have some interest in the price of gold because of its effect on the currency markets. (4) What kind of relationship does exist between gold and the currency markets which are much bigger than the gold market?

John Embry: Very simple. Gold is a currency. Arguably it is the ultimate currency and the central bankers are acutely aware of this fact. Gold’s role as currency is once again coming to the fore and the central bankers hate that fact.

Are gold swap arrangements between central banks a) important for the “management“ of the gold price, and b) do they represent a means of intervention in the gold market?

John Embry: They are most certainly important because it allows central bankers to technically tell the truth because it is always another central bank that is utilizing the swapped gold to intervene in the market. It is a subterfuge.

Do you think the Western central banks have as much gold as they claim they have?

John Embry: I strongly suspect that they have materially less than they try to represent. The IMF permits a one line entry on their balance sheets which aggregates physical gold with gold receivables. That’s ridiculous and it is done to deceive analysts. For example, if the Americans had the 8,161 tonnes that they say they have, they would be delighted to submit to an outside audit and shut their detractors up. However, they stonewall all requests.

With its “QE to infinity“ program: would you say the Fed has exposed itself in a way as a hardcore goldbug entity?

John Embry: I believe they are fully aware of the extent to which they are debasing their money. We, the public, have to be the hardcore gold bugs to protect our wealth from their depredations.

It seems as if more and more gold is moving towards certain central banks and not away from them. Is this a solid assurance that the gold price will remain high?

John Embry: I believe so. The eastern central banks (China, Russia, et al) have accumulated a lot of dollars and realize they are at risk. Ergo, they buy gold. At the same time, I think the western central banks have run their inventories down to levels beyond which they won’t go. Thus, I think central banks collective gold buying will have a salutary impact on the price going forward.

In the event of another market meltdown, which seems rather likely, do you expect a sell-off in gold?

John Embry: There could be a minor sell-off just because there are so many algorhythyms influencing the market. It would be short lived because big money in the world now knows they need gold for protection.

Gold is in a bull market for ten years now. So an increasing number of people say it is in a bubble. Why would you say, in Gershwin’s words, “it ain’t necessarily so“?

John Embry: Gold’s price is directly related to the constant debasement of the currencies in which it is denominated. The creation of new paper money is dwarfing the amount of gold available. Gold is about the furthest thing from a bubble that I can think of.

What do you think in particular about Warren Buffett’s constant “Gold is in a bubble, I go for stocks“ talk? Does he serve here as an influential opinion maker in a specific role because he gets a lot of public attention? In other words: is he a fool or does he only act like a fool? (5)

John Embry: Warren Buffet sold out a long time ago. It’s too bad because he was a great stock picker once. Now he owns insurance companies, Wells Fargo and was a buyer of Goldman Sachs and G.E. in the global financial crisis. He is a member of the American establishment and has a lot to lose. He should have listened to his father Howard Buffett who was a U.S. Congressman and a true “hard money” advocate.

In your view, gold will gain in importance as a monetary asset in the years ahead, likely regaining an official role in the world’s financial system. Why do you think so?

John Embry: I think that the current financial system, as we know it, will be totally destroyed, probably sooner rather than later. The next system will require gold backing to have any legitimacy. This has happened many times in history.

The mining stocks both in gold and silver seem to me extremely undervalued. Do you agree?

John Embry: They are indeed, and they are being heavily manipulated by the same entities active in suppressing the gold price. In addition, many nefarious hedge funds now are active on the short side. The U.S. financial scene has become a total cesspool.

Are there key levels in the XAU and HUI that one should pay attention to as starting points of a mining stock rally?

John Embry: I tend to pay more attention to the HUI because it is the pure gold index. When the HUI takes out the 555 level with gusto, I think we are away to the races. However, this level is being aggressively defended by the bad guys. A higher gold price (through $2000 per oz.) will rectify this issue.

Why are you at Sprott Asset MGMT so very bullish related to silver?

John Embry: We think the supply-demand equation is ultimately better than even that of gold. New industrial and medical uses are exploding and because silver is “poor man’s gold,” investment demand for silver will go crazy when gold gets priced out of the average citizen’s capacity to buy. Given the small size of the market and very limited inventory, the price should go ballistic.

For your physical silver ETF you want to re-acquire physical silver in a big way. Do you think you could be pioneers (for other fund managers) in direct engagement with mines through direct and forward transactions, instead of going to the Comex? You certainly don’t want to “whoop” the silver price by your own buying, correct?

John Embry: I think that is a potential avenue particularly when the supply-demand equation gets progressively tighter in the future.

Is the silver market also subject of surreptitious interventions?

John Embry: Without question. In many ways it may be worse because it is a smaller market and J.P. Morgan Chase’s activities have been egregious. The fact that the CFTC has been investigating this for nearly four years without resolution is one of the great jokes of all time.

What is your information: to which extent the US silver ETFs are short and how many stocks of those have been used for covering future short contracts?

John Embry: I believe that they are but I can’t provide any information on the extent. When the very same organizations that have manipulated the market for years act as custodians for the ETF’s, it would be wise to be wary.

One highly interesting issue for me personally is the point in time when the Middle East countries will no longer sell their oil and natural gas for paper money. When do you think they will be paid for it with precious metals?

John Embry: I suspect this whole phenomenon could occur very quickly. When confidence in paper money is lost and I think we are rapidly approaching that moment, something like that would undoubtedly come to pass.

How do you think about the conflict around Iran viewed from a perspective of the petrodollar?

John Embry: The whole Iranian issue is very disturbing and I think the U.S ‘s motives might have more to do with the petrodollar than Iran’s nuclear ambitions.

One final question. IF the financial system goes under, one can expect massive supply shortfalls and disruptions in goods and services, particularly in the energy sector. Would you recommend to our readers to take precautions for such a scenario instead of hoping for the best outcome of the global financial crisis?

John Embry: Unfortunately yes. I am a great believer in cognitive dissonance. Most individuals don’t want to face the truth, particularly if it is very unpleasant. Those that do not suffer from this condition should take precautions because the world situation is presently very dangerous.

Thank you very much for taking your time, Mr. Embry!

SOURCES:

(1) John Embry / Andrew Hepburn: “Not Free, Not Fair: The Long-Term Manipulation of the Gold Price”, published by Sprott Asset Management in August 2004 under:

http://www.sprott.com/Docs/SpecialReports/08_2004_NotFreeNotFair.pdf.

(2) See Rob Kirby: “Manifest Destiny Derailed: Treason from Within“, published at Goldseek on January 31, 2012 under:

http://news.goldseek.com/GoldSeek/1328037291.php.

(3) Compare http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf.

The relevant passage of Mr. Warsh’s letter to GATA said:

“In connection with your appeal, I have confirmed that the information withheld under Exemption 4″ — that’s Exemption 4 of the Freedom of Information Act — “consists of confidential commercial or financial information relating to the operations of the Federal Reserve Banks that was obtained within the meaning of Exemption 4. This includes information relating to swap arrangements with foreign banks on behalf of the Federal Reserve System and is not the type of information that is customarily disclosed to the public. This information was properly withheld from you.”

(4) See Rob Kirby: “Manifest Destiny Derailed: Treason from Within,“ Footnote 2.

(5) Compare for example in this context what Marshall Auerback has said in an interview about the supression of the silver price:

“It’s in contrast to the gold suppression, which is a central-bank orchestrated scheme. You’ve got a situation now where it seems to be being done amongst the banking community, but I have no doubt that it has being done with official encouragement, explicit or implicit. To give you an example, 10 years ago Warren Buffet bought a silver position, and he liquidated it a few months later. The story I heard from one of his dealers was that he basically told them, “Boys, it’s not politically correct to speculate in silver.” Now who told him that I don’t actually know; I suspect it came from government sources. More interesting to me is that he had had a significant position, and it was liquidated with a great degree of ease with a loss at time when it wasn’t easy to do. This suggests that there was an external agency involved. I have no doubt that there is some degree of government involvement as well, but the primary agents are the investment banks, the commercial banks here.”

See: http://resourceclips.com/2011/04/05/marshall-auerback-on-silver/.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

KWN – EvG – Gold could be $2,000 by end March

“The risks are enormous, Eric. The risk that many banks will fail is major. The authorities and central banks, around the world, are going to try to rescue them, but it’s not certain they can or will. That’s why, again, it’s important to hold assets outside the banking system, whether it’s gold or silver or assets in the ground.

That’s the way to protect yourself because if the system survives in the next couple of years, it will only be because there is massive money printing….

Continue reading the Egon von Greyerz interview on KWN..

KWN – EvG – Gold could be $2,000 by end March

Alf Field, my good friend and Elliott Wave Expert par excellence, has produced a superb analysis on silver forecasting that the next objective for silver is $ 158 which corresponds with his $ 4,500 target for gold.

Egon von Greyerz

A new Elliott Wave Silver Discovery

By Alf Field

I have received numerous emails asking about silver. This article was prompted by a question enquiring what the silver price might be if my gold forecast of $4,500 proved to be correct.The question caused me to take a closer look at silver.

The reason why I have written very little about silver in the past was because the beautiful Elliott Wave (EW) symmetry and predictable relationships visible in gold were not to be found in silver. This article reveals a new EW discovery that proves that EW is alive and well and living in silver.

I first wrote about silver in December 2003 in an article titled “US Dollar Implosion – Part II”. The link to this article is at: http://www.gold-eagle.com/editorials_03/field120503.html. The brief piece on silver was tacked onto the end of that article. In view of its brevity, the 2003 silver piece is reproduced in full below:

SILVER

“In past crises, the wealthy protected themselves by purchasing gold and gold related assets. Ordinary people, by far the greater number, could rarely afford to buy gold. Being far cheaper, they previously had to buy silver. This metal became the poor man’s choice as an asset to protect their savings. Silver has so far lagged gold in the early stages of this bull market, but that situation seems about to change.”

“Throughout recorded history the average relationship between silver and gold has been 15oz silver to 1oz gold. The ratio at present is a far higher 75:1 ($400/$5.30). This is massively out of line. If gold were to double to $800 per oz, it would not be unreasonable to expect the silver/gold ratio to decline sharply, possibly as low as 40:1. With gold at $800, this would position silver at $20.

Thus a 100% increase in the price of gold could possibly be accompanied by a simultaneous 400% increase (perhaps more) in the price of silver. This offers significant opportunities both in silver bullion and silver mining shares.

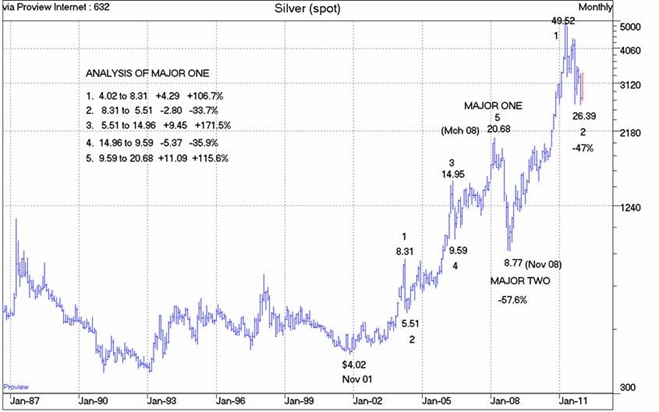

The above graph of the price of silver has been borrowed from an excellent recent article by Dan Norcini entitled “A Technical Look at Silver – Update”. What is quite clear from the graph is that silver’s 22-year bear market down trend has come to an end. As Dan Norcini says, a new bull market in silver has been born. It is difficult to argue against this contention and I have no intention of doing so. A silver price above $6.80 would complete a fabulous head-and-shoulders base formation. With this as a foundation, it would be possible to project a very large rise in the price of silver for the future.” – end of the December 2003 quotation.

Silver did reach $20.68 in March 2008 at the same time that gold peaked at $1003. The silver to gold ratio was thus 48.5 in March 2008. The lowest this ratio has reached is about 32, achieved at the end of April 2011 when gold was around $1570 and silver peaked in the $49 area. At that point gold had experienced a 6-fold increase from its bull market starting point of $255 while the silver price rose 12-fold from its bull market starting point of $4 in November 2001.

The quick answer to the question of what the silver price will be when gold gets to $4,500 is to pick your favorite silver/gold ratio and divide it into $4500. The current ratio incidentally is about 51. If you choose the lowest ratio achieved since 2001 of 32 that would produce a silver price of around $140 ($4500 divided by 32).

This is not a satisfactory answer, so I decided to approach the Elliott Wave analysis of silver from a different angle. Instead of working upwards using the analysis of the minor waves, which was the technique used in the gold calculations, what if we worked backwards in silver starting with the larger waves?

Gold and silver tend to move in tandem, not in an exact synchronization, but enough to suggest that the Major waves of both metals should coincide from a time perspective. We know that in gold the Major ONE wave peaked in March 2008 at $1003 and that Major TWO declined to $680 in November 2008.

Silver also had a peak in March 2008 at $20.68 and declined to an important low of $8.77 in November 2008. If we assumed that the peak at $20.68 in March 2008 was the end of Major ONE and the decline to $8.77 the end of Major TWO, how would the various percentages work out? When I did these calculations I was astonished at the relationships and wave counts that emerged.

The chart below is the monthly spot silver price shown in log scale so that the percentage changes are visible. The bull market started in November 2001 at a price of $4.02. From that point to the suggested peak of Major ONE at $20.68 there are five clear waves visible, marked 1-2-3-4-5. The prices at the various turning points are also displayed.

The analysis of the suggested Major ONE wave is set out in the body of the chart. The typical impulse wave relationships are immediately apparent. Both corrective waves 2 and 4 are similar (-33.7% and -35.9%). Whenever two corrective waves are similar it is a signal that they are part of the same larger wave structure. On its own, this fact would confirm that the 5 wave move from $4.02 to $20.68 was a complete wave of larger degree.

There is further corroborating evidence. Waves 1 and 5 are similar at +106% and +115%, a usual EW feature. Wave 3 should be the longest wave, and it is at +171%. In addition, if one multiplies the gain in wave 1 of +106% by 1.618 it produces 171.5%, exactly the gain in wave 3. These relationships are evidence that the rise from $4.02 to $20.68 is a completed impulse wave and that we can call it Major ONE.

Having completed this 5 wave up move, the next correction in Major TWO would be expected to be one degree larger than the two corrections of 33.7% and 35.9% in Major ONE. As shown on the chart, Major TWO declined from $20.68 to $8.77, a loss of -57.6%. The two corrections of 33.7% and 35.9% are close to the Fibonacci 34. The next higher number in the sequence is 55, close to the actual decline of 57.6% in major TWO. Incidentally, if we take the 35.9% decline and multiply it by 1.618, it gives a figure of 58%, very close to the actual decline of 57.6%.

These relationships suggest that silver has completed the same shaped bull market as gold has and that it is at the same stage in its development. Thus silver has probably also completed the first intermediate up wave of Major THREE, in this case from $8.77 to $49.52, a gain of +$40.75 or +464% and has also completed intermediate wave 2 of Major THREE, being the decline from $49.52 to $26.39 or -47%.

How does this decline of -47% measure up in terms of EW relationships? As with gold, where the corrections in Major THREE were shown to be larger than the corrections in Major ONE, the same applies to silver. The corrections in Major ONE shown in the chart above were close to -34%. If we multiply 34% by another Fibonacci relationship of 1.382 we get 47%!

This is mind-blowing stuff for an analyst who did not believe that EW applied to silver!

We can now attempt to make some price forecasts. Silver, as with gold, is starting intermediate wave 3 of Major THREE, which should be the longest and strongest wave in the bull market. It should certainly be longer than intermediate wave 1 which was the gain from $8.77 to $49.52, or +464%, as shown above.

Thus the gain in wave 3 of Major THREE should be larger than +464%. It should be a gain of at least 500%. Starting from the $26.39 low, a gain of 500% would produce a target price of $158.34 for silver. That is the number which equates with the $4500 price forecast for gold and produces a silver to gold ratio of 28.4 ($4500 divided by 158.34).

The gain in gold was forecast to be 200% for this move while the forecast rise in the silver price is 500%. Silver is again predicted to perform better than gold based on these EW calculations.

A word of caution is appropriate at this stage. All EW studies are based on probabilities. While the wave counts may provide a high degree of confidence in the forecasts, one cannot be 100% certain of any forecast. It is necessary to have a point at which it is obvious that the forecasts are wrong. In the case of this silver study, the line in the sand is at $26.00. If the silver price drops below $26.00 the odds are that the above calculations will not work out.

A further word of caution: silver is not for the faint hearted. Silver is considerably more volatile than gold and the corrections are much larger. Silver corrections can and do happen quickly. They are emotionally gut-wrenching and it is easy to get shaken out of one’s position near the bottom of a large correction.

Alf Field

1 February 2012

Disclosure and Disclaimer Statement: The author has personal investments in gold and silver bullion, as well as in gold, silver, uranium and base metal mining shares. The author’s objective in writing this article is to interest potential investors in this subject to the point where they are encouraged to conduct their own further diligent research. Neither the information nor the opinions expressed should be construed as a solicitation to buy or sell any stock, currency or commodity. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions. The author has neither been paid nor received any other inducement to write this article.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.