The economist / oil analyst Maarten van Mourik examines in this exclusive interview the link between gold and oil; important taboos in economics; the USA vs. Europe; the dilemma with our energy-driven monetary system; and last but not least the reason why “peak oil will be here, no matter how much of the stuff is in the ground.”

By Lars Schall

Maarten van Mourik (born 1967 in the Netherlands) studied micro-economics / industrial economics and shipping economics at Erasmus University in Rotterdam, Netherlands between 1988 and 1991. Afterwards he worked with the Netherlands Economic Institute on transportation policy research, mainly maritime transport. For Petrodata Ltd of Scotland he was doing offshore drilling rig and marine support vessel market forecasting. From 2000 onwards he has had his own business, doing bottom-up field by field non-OPEC supply forecasting, oil market analysis as well as forecasting offshore equipment markets. The work was supplied to OPEC as well as investment funds. As an economist he has worked on port infrastructure feasibility studies around the world. Today, Mr. van Mourik works still for his own account and as an economist for North Sea Group in Holland. He favours independent analysis, Austrian economics and an eclectic approach to analysing and predicting market behaviour. He currently lives in France.

Mr. van Mourik, you have read my article “Germany should end the secrecy and bring its gold home” at GATA’s website and the reference I made in it to the development of gold as a currency for commodities rather than dollars. (1) You found this remarkable. Why so?

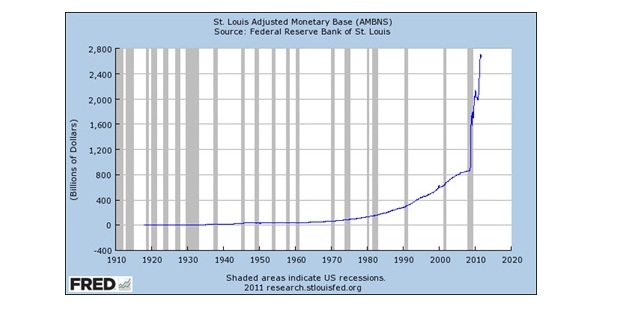

Maarten van Mourik: Well, I happen to be an economist and have been working in the oil analysis business for a long time. In fact, I was one of the very first to come up with a special oil production model based on actual oilfield investments. And on the back of that model I built a little price model that predicted 100+ dollar oil when it was still stuck around 30-40 and everybody thought I was a lunatic. I developed it further, and somewhere last year I saw a chart in “The Economist” showing the dollar price of gold inverted, which shows nicely how fast the real value of the dollar has collapsed since 1971, and also the further collapse since the late 1990s. It made me think I should express the price of oil in gold rather than dollars, because as you wrote, the producers like to have real value rather than a worthless piece of paper. In fact, OPEC has been arguing against dollar depreciation since the mid 1970s and it is one reason why they use a basket price to establish their selling price.

But apart from that, where I first got a good fit between the tightness in the global crude oil market and the price of oil in dollars, I now got an absolutely brilliant fit with the price of oil in gold. That result suggests to me that the process is already much further along than you might think and we are actually witnessing the collapse of the dollar. The U.S. knows it, Europe knows it. But I believe that Europe is stronger than the U.S. and the U.S. has everything to lose when the dollar goes as reserve currency. Hence, they will do anything to have Europe collapse before they go. It is not for nothing that the news media keep bickering about Europe, while the mess in the U.S. is much bigger with states and counties that already have defaulted.

Do you still have to develop this gold-oil model?

Maarten van Mourik: Yes, it is work in progress. I’m still trying to figure the things out how the fundamentals work and how that impacts prices. I am in discussion with some mathematicians to model the different processes and I know from my own work that these fundamental processes actually determine the turning points which are hard to model. So it is best to have an understanding of what is going on, then make that explicit, and then use that as indications of turning points. I read the gold issue in particular as a flight to real value (the anchor to measure against) and indeed the fact that the Western governments are losing control. Once they lose it, there will be a free fall and gold will spike.

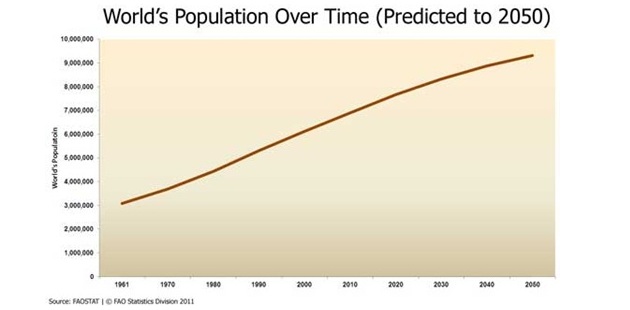

Your work and GATA’s suggests that they have been deliberately playing this game for many years, until they lost fire power. So the conclusions then need to be drawn. What will happen next? Civil unrest? Likely. Check the Bundeswehr website and Der Spiegel on the study of the Bundeswehr on the effects of peak oil. They insist the army needs to prepare for major civil strife instead of foreign war. (2) I know you have heard about peak oil. I am not a geologist, but I know from the data I have on oil fields that money drives everything.

And when the money becomes worthless, investment will stop. Then peak oil will be here, no matter how much of the stuff is in the ground. The price of commodities will spike in nominal terms, not so much in gold (although I take issue with the quote that on average it is 15-16 barrels per troy ounce – I have the data back to 1971, which is the most uncontrolled series, as prior to 1971 both gold and oil were more or less fixed), and it jumps up and down between something like 6 and 24 barrels per troy ounce. Most of that movement, in particular in the latter years, is smack in tune with the developments of physical tightness in the markets, as if OPEC is pricing in gold rather than dollars.

What would be the next effect?

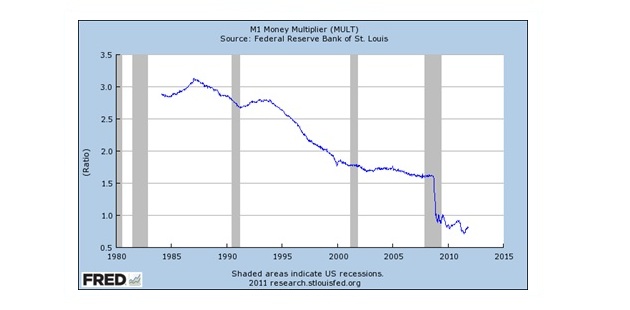

Maarten van Mourik: A shutdown of liquidity, likely. Which will lead to collapsing commodity prices, just as in 2008/09. Only to move back up once trade credit gets back online. We’re in for something very, very volatile. And the past few years have been the early warning tremors.

Is it difficult to get those things recognized?

Maarten van Mourik: Well, Dr. Birol from the International Energy Agency (IEA) in Paris came out with a statement ahead of the release of the new World Economic Outlook to say that oil prices will be high and volatile throughout the coming 25 years. Well, that one anybody could see coming who bothered to look. But not the main agencies. Does not matter as such, but again they are wrong, again they show they have no imagination or understanding of the processes at work. We are in the midst of an adjustment process, going from one base-load fuel to the next and at the same time the whole edifice of fiat currency comes tumbling down.

This is a major economic earthquake and the acceptable agencies are talking about high and volatile prices for 25 years. Clearly they have no idea as to how pricing works. Price will rise to kill demand. That one they figured out, but as it is oil, we will abandon almost everything else, before we start to use less. In essence, we will have to shrink our economies to go to sustainable levels and then we’ll grow again with new industries. I am terribly optimistic in that respect. It could have been done through decent industrial policy, but that is something that has been abandoned a long time ago and industrial economics is a subject that is taboo.

For what reason?

Maarten van Mourik: The reason is simple, it does not fit with traditional economics, because it is eclectic. As it is eclectic, no hedonistic modelling is possible, rationalist man is not there and, of course, it then has no merit. Unfortunately, we are not so rational. Or we are, but not in the way that economic theory wants us to be. Perhaps a few people should read Mises and Hayek and preferably Joseph Schumpeter on the subjects.

The latter, who was praised by my favourite economist John Kenneth Galbraith as “the most sophisticated conservative” of the 20th Century, is the theorist of “Creative Destruction” as the driving force of capitalism. (3)

Maarten van Mourik: Yes, you’re right. – The consequence of the analysis in my view is that we’ll go against the wall in the coming 6-12 months or so, starting with oil. Simply put, the physical stocks are very low, production is lagging and no refinery is running at full speed. Price will spike, demand will falter as the economy cannot support high prices. Recession follows, demand falls a bit, prices come off, and investment in new oil stalls. Oil supply drops quickly, demand stabilises and we are at the market balance point again in no time, but at a lower level.

The process will repeat itself another two or three times and then it will be over. This is a maximum 5-10 year scenario. Volatile pricing will be gone by then, because the processes to walk away from oil will have become entrenched. The process started 10 years ago in the financial markets putting pressure on Big Oil. They reacted, and now Big Oil is becoming Big Gas. Shell has said so at their 3rd quarter earnings release: ”We are considered a big international oil company, but we produce more gas than oil.” Too right. The moment these guys can move away from oil altogether without damaging their balance sheet due to reserves that would have to priced low, they will do so. And at that point in time, the game is over for oil as a primary driver. Simply because the scale in the money will have moved away. I cannot understand why the IEA fails to recognize this phenomenon.

In the meantime, the oil producing countries are buying gold to protect themselves. The U.S. of A. is lambasting the European Union and putting Wall Street ahead of the cart to speculate against us, with the core media as biased channels distorting everything. Down with the Euro to abolish the only credible alternative to the reserve currency. The problem that still exist is that Germany effectively produces things that everybody wants. Unlike the U.S. they can export their way out of the mess.

Thus there is true productive back-up for a sound currency, including the steadfastness of the Bundesbank. All ingredients that put the fiat in the U.S. at risk. The only solution for the Americans is to effectively rip the EU apart. They will try to do so in my view, as their time horizon is only very short. Take a look at savings ratios in the U.S. versus the European countries. Except for the Greeks and the English, most are very strong savers. While the bank problem is massive, at least there is saving going on. The core problem is in the U.S. and the UK. Whatever they make Reuters say. (Have a look at the article a few weeks ago on Reuters saying that MF Global was the first victim of the Euro crisis, because the company had bet against the Eurobonds and then the Eurobond prices had the temerity to go the opposite way…the line of reasoning is disgusting, but the headline is there. (4) It is Europe’s fault.)

What is your more comprehensive view related to the new long-term forecasts both of the IEA and OPEC?

Marten van Mourik: I think that their long term projections nicely show the ever increasing need for oil as world population expands. They are also diplomatically conversing with each other in a way they have been doing for many years in my view. The IEA says that sufficient investment needs to be undertaken by OPEC to keep the supply system working. OPEC says it wants demand guarantees in order to put the money in the ground to produce the oil. Effectively, I do not believe there is a long term. There is only a string of shorter terms that create a long term path in hindsight. For while it is nice to show that oil demand will grow to 100 Mb/d+ by 2035, the situation is that currently the oil industry has difficulties in delivering what is wanted now.

There are plenty reasons as to why there are difficulties. Limited resources, difficult and harsh environments spring to mind. But another, much more important one in my view is the immediate business environment and horizon. That business horizon is never much longer than 3-5 years. Everything that is longer can be changed reasonably easily. In a volatile price environment, companies will become increasingly reluctant to spend. The reason is simply that the business case becomes volatile as well. Over the past years, costs have zoomed up, while price has bounced all over the place. At the same time demand retracted and then surged and now shows signs of stalling in some areas.

How can one expect oil companies to invest sufficiently to deliver the oil? How can one expect OPEC to do so? For what is the business proposition of a project that is designed to provide more oil production capacity, that is to be idled for years waiting for the days when there might be shortage, and that capacity also lowers the price on the existing production? It did not take long for Saudi to be reported in the press to say that their oil development plans of 100 billion USD were to be frozen after the IEA released its long term outlook. Therewith, in one fell swoop, fell the bottom from underneath the long term outlook.

The short term special case in the IEA outlook has been activated, which should lead to a spike in the oil price. A sharp spike in the oil price, perhaps combined with signs of physical shortage would completely change the long term outlook. Physical shortage would dramatically change the mindset of the Western consumers. And then the bets may be off for demand. In short then, while I appreciate the long term outlooks, they are as much a diplomatic weapon as they are projections of a long term future. They are also made to make politicians view the surrounding world. But it is hard to spell out in clear writing, that oil shocks are here, and that they won’t go away nicely. (5)

So you are extremely sceptical that the world has enough oil in inventory or spare capacity? Moreover, Gregor Macdonald wrote in an article with the headline “Spare Capacity Theory“ the following:

“In truth, the spare capacity that the world cares about – that the oil futures market cares about – is not the inventory level. But rather, actual production capacity that can be brought on immediately.” (6)

Is this observation by Mr. Macdonald correct?

Maarten van Mourik: I would recommend to read a presentation I did in 2005 on spare capacity and the oil price,“Back to fundamentals: Oil price forecasting in a new oil market.“ It was the formalisation of the oil price model we’ve talked about. The fact is that spare production capacity was not an issue on anybody’s mind really until somewhere in early 2008. To put the issue into perspective, the IEA released oil this summer because of a fear of a supply crunch (which is coming anyway). That move can likewise be construed as allowing Saudi to posture as the one still having spare capacity. For Saudi can say, well, we increased production (hardly anybody took their Libyan lookalike however), but these imperialist Western governments pre-empted our good intentions to help out, they released their emergency stocks and so we were not required to make use of all our expensive excess capacity.

At the same time, Saudi increased production levels this summer to close to 10 Mb/d, 1 Mb/d above spring season levels, apparently all required for domestic consumption, as not a single barrel extra was exported. Who knows if they are honest in saying that they were pumping? Who is checking the installations? So everybody is happy, for it is also in the interest of the Western governments that the mirage of spare capacity is maintained – since if that mirage whirls up in smoke, full panic will break out and a scramble for the last barrels will start.

I thus support McDonald’s view, although the inventory levels are short term indicators of the market. I maintain the view that it is in nobody’s interest on the producers or consumers side to increase production. Why kill the goose with the golden eggs?

For your and the readers info, the co-author of the presentation was my then-business partner, and he was the previous owner of a company called Petrodata which collected (and still does) information on drilling rigs and offshore fields. That company is now owned by IHSEnergy (owner of CERA a.o.), which controls the Petroconsultants oil and gas field database as well as information channels as Fairplay. It is in part owned by a financial institution. I guess that makes sense, because control of the information allows one to take advantage of the markets. Which is OK in my view. It is just a pity that governments cannot be bothered in trying to get the picture right and set the frameworks as they should. That is their job.

Related to the Saudi oil production, Marshall Auerback told me not so long ago:

“If Saudi Arabia is the swing producer they would have to cut production to 4 million barrels a day.” (7)

Given his full reasoning for stating this, do you agree with him?

Maarten van Mourik: No, I don’t agree, except perhaps if there were a sudden collapse. We’re at the margin of capacity, and we will remain so until we find another way of using the oil or other resources for the same purposes. If demand grows at half the current rates, where would be the incentive to invest? The large scale production increments are not coming from non-OPEC. 2010 was a freak occurrence. While great things may be happening onshore in the U.S., it is unlikely to ever become very large scale. By that I mean something that would allow very low import levels in the U.S. Peak oil has happened, not in all liquids, but in crude oil it surely looks that way. Massive investment has been undertaken, yet crude oil production is struggling to stay flat. If non-OPEC does not deliver, OPEC will need to. But OPEC has said at every turn, it will not step in if the demand is not there.

In 2003, when the world was consuming a billion barrels of oil every twelve days, you have said with regards to new explorations: “It is way too expensive. The cost is fifty to sixty million per rig and there is little guaranteed return.” You further said something quite chilling related to Peak Oil: “It may not be profitable to slow decline.” (8) What does this mean put together with each other?

Maarten van Mourik: Well, without access to easy, cheap flowing oil the cost of the incremental barrel is high and rising for the commercial oil companies. High and rising cost means that profit and profit growth are under pressure if the oil price does not rise simultaneously. That in turn means that the attractiveness of the stock price is reduced and hence the value of the companies. The big oil companies have been spending lots of money on exploration and production. But they have also spent large amounts on buying back shares, which definitely does not produce oil.

Furthermore, the private companies are in a continuous mode of high grading their portfolio. That is to say, financial high grading, because these are businesses and they pump money, not oil for oil’s sake. High grading means for all practical purpose selling of assets, be they prospects or producing. Thus, these companies will not grow their business in volumetric terms. Quite to the contrary in liquids. This is a phenomenon that exists along the entire spectrum of oil companies, be they huge, big or minnow. Assets cannot just be taken over by the next oil company that comes along. Development requires scale in organisation, experience and access to money.

The effects of the process and what I said in 2003 are there to see for everybody in the North Sea offshore oil production. Assets have been sold to smaller oil companies, who have invested in new and older fields. Decline has been fought, but not tooth and nail. For in 2003 the North Sea had been well in decline for four years already. The North Sea peaked at around 6 million barrels / day of oil production (Mb/d). Eight years later, the decline has continued almost unabated. Production is currently around 3.4 Mb/d. The inaction is not for want of reserves. There is plenty oil left. The area can be considered politically low risk as well. It is just that the oil is just too expensive to make sufficient profits on a sufficiently large scale.

Do you think that gold will indeed be used in the future as a pricing mechanism for oil and other natural resources?

Maarten van Mourik: I do think so, yes. Frankly, I think it is already happening, although in a sort of disguised way. OPEC has been arguing about the effects of dollar devaluation on their petroleum revenues since the ‘70s. It would now seem that oil is effectively priced against gold, or at least a basket that has close correlation with gold. The correlations are not continuously strong, but at times they are very high. To me it is only logic that gold or an equivalent (is there any?) would be used for the supply of real products.

It would be good for the economy to do so, as the real price would better reflect scarcity and thus better inform decisions as to the use of the products. While there may be plenty of oil still around, the cheapest barrel of oil is the one that is not consumed. If oil were to rise constantly in real terms, or even spike, adjustment processes would start to be more efficient in many respects. For up to quite recently, energy has been dirt cheap. And with the price ridiculously low, it has been wasted and we have been lulled into some sort of complacency, that the oil would always be there.

It has also allowed us to spend money on things that would not have been within reach had energy been more expensive and reflected the long term average replacement cost. It is conceivable that the financial exuberance would have been on a different scale, as the household budgets would simply not have been big enough. Furthermore, if oil and other natural resources were to be priced in gold, they would be one step further out of reach of currency manipulation that boosts nominal prices. That would reduce volatility and thus stabilise the future business environment.

What would happen to the U.S. economy if the “Petrodollar system” would finally collapse?

Maarten van Mourik: You mean if oil and so were to be priced in gold?

Yes.

Maarten van Mourik: Insofar the Petrodollar system is still fully in place, I would guess that the U.S. would take a big hit.

Another thing that I see coming is the necessity for continental Europe to develop an energy alliance with the eastern parts of Eurasia. Am I right?

Maarten van Mourik: Yes, I would think you are right there. Simply put, large resources are in eastern Eurasia. While the West may not like the politics too much, the resources are within easy transportation. Europe is also a nice customer I would reckon for these resource owners, giving them the possibility to keep a diversified customer base.

How do you as an economist evaluate the work done by GATA? Do you think they face similar problems as the Peak Oil advocates?

Maarten van Mourik: Did you read the article in the Financial Times that discussed GATA recently? It was not derided completely, which I found interesting, as typically mainstream media will laugh away everything that sounds out of the box. (9)

In your assessment, is it by coincidence that the global debt bubble is about to burst now that natural resources and credit seem to hit their limits?

Maarten van Mourik: I refer to my earlier point on household budgets. But the same goes for government budgets. I do not think it is a coincidence. Too much space of the budget room that was created by too low prices for natural resources has been used to service increased debt loads. The moment the budget was squeezed by real, necessary items, such as energy, the room to keep servicing the debt was gone. Effectively, the price of energy has for a long time not represented the long run average cost, but the short term marginal cost. In a situation of substantial overcapacity, that short term cost is very low indeed. But once the overcapacity is gone, price needs to rise to reflect the investment required to install new capacity. And then suddenly prices go through the roof. It has happened with gas, it has happened in specific markets in electricity, it has happened with oil. Perhaps one has to ask the question if these products should really be left to the free market in the way it is working now.

Richard Heinberg told me in an interview the following:

“Our current money system requires constant growth so as to enable repayment of the interest on the debts that created the money to begin with, so it cannot function well in the context of general resource scarcity and economic contraction.” (10)

Is this the key dilemma of our time? And how would you say does gold fit into this energy-monetary picture?

Maarten van Mourik: Well, that is certainly a key issue. I would expect that the current tremors in the markets would lead to several spikes in order to signal that the resources ARE scarce and that Man has to come up with a next plan. Effectively, Man has to move to the next energy source that is relatively abundant. The fact that growth cannot be sustained from the current resource mix requires a shock to enable change. Look at it as a sort of technological hurdle that needs to be taken, or perhaps a frame of mind that pushes us to actually do things differently. To cross the hurdle, substantial investments need to be undertaken, dislocations of people and re-arrangements of industries and services. That means a period of stagnation or decline, after which in a re-arranged system, the money system could take off again. Gold would help in making the transition, because it would work as an anchor. With everything in flux during a mega-makeover, something somewhere needs to be stable.

Why is there a unique spread between WTI and Brent crude oil that takes place now really for the first time?

Maarten van Mourik: As far as I have followed this, it is predominantly a logistical issue within the U.S. Too much crude flowing into the pricing point of WTI, with too few outlets going to places where the crude would be in contact with other crudes, i.e. the U.S. Gulf Coast. As such, there has been, and still is, a breakdown in the system of communicating barrels. It won’t last. Pipelines are being reversed and built, rail infrastructure is being built. With a little bit of time, the communication is restored.

One final question. Can we accomplish the same amount of productivity and wealth with fewer natural resources?

Maarten van Mourik: Yes, I believe so. Otherwise we would not have arrived as Man where we are now. There have been more of these money/resource upheavals in the past at lower levels of development. We passed through it, and found ourselves with a resource with more energy content. Besides, there is undoubtedly huge opportunity in becoming much, much less wasteful and thus much more efficient than we have been so far. It just requires the will to change and adjust.

Thank you very much for taking your time, Mr. van Mourik!

SOURCES:

(1) Lars Schall: “Germany should end the secrecy and bring its gold home”, published at GATA.org on October 10, 2011 under: http://www.gata.org/node/10550

(2) Compare for example Lars Schall: “The Smouldering Political Risks are not Fully Priced into the Oil Price”, Interview with Ronald Stoeferle, published at LarsSchall.com on March 11, 2011 under:

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.